✅ What to expect

- The Fed’s policy‐setting body, the Federal Open Market Committee (FOMC), is meeting over 28–29 October 2025.

- Markets expect a 0.25 percentage point (25 basis point) cut to the target federal funds rate, bringing it to 3.75%–4.00% from the current range.

- The economic backdrop is mixed: inflation is easing somewhat, but the labour market shows signs of cooling; at the same time, a U.S. government shutdown is limiting data availability.

- The Fed is also thought to be nearing the end of its “quantitative tightening” (QT) programme which has been reducing its balance sheet.

🧐 Why this matters

- A rate cut lowers borrowing costs: for consumers, businesses, and governments. This generally supports spending and investment.

- But cutting while inflation remains above the Fed’s longer-run target (~2%) introduces risk of inflation rebound.

- The signalling is key: even if the rate is cut, what the Fed says about future policy, the economy and inflation will drive markets (stocks, bonds, dollar, emerging markets).

- For international economies (such as India) and emerging markets, U.S. interest-rate decisions influence capital flows, exchange rates, and global risk sentiment.

🔍 Key uncertainties & what to watch

- Data blackout: The government shutdown in the U.S. means many key indicators (jobs, inflation, etc) are delayed or missing. Makes decision-making harder for the Fed.

- Labour market: Signs of cooling (rising unemployment claims) are noted, which may push the Fed toward easing.

- Inflation: Although inflation has cooled a bit (CPI ~3% recently) it remains above target; the Fed needs to balance supporting growth and containing inflation.

- QT and liquidity: Recent stress in money markets and banks raising backup funding have caused the Fed to rethink QT.

- Forward guidance: Markets will listen for clues on how many more cuts might follow, or if the Fed will pause.

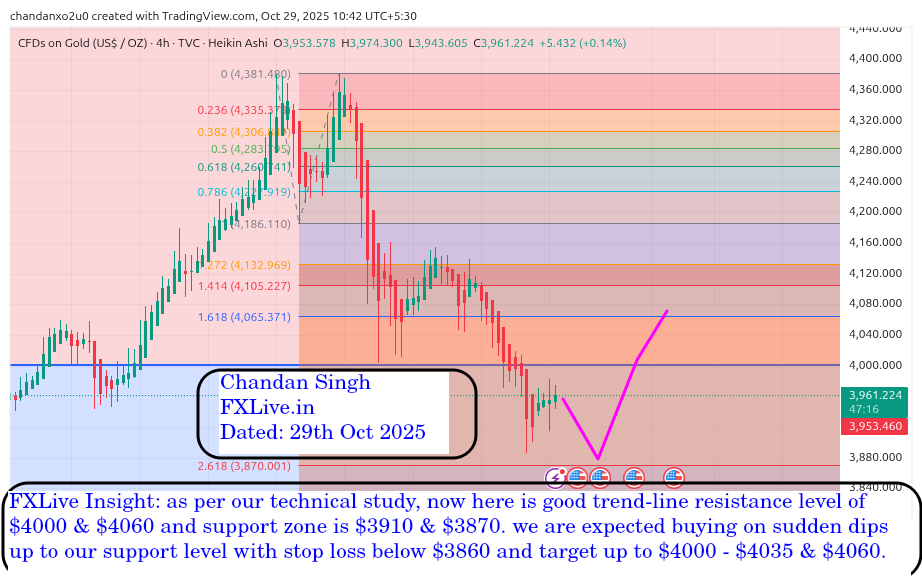

FXLive Insight: as per our technical study, now here is good trend-line resistance level of $4000 & $4060 and support zone is $3910 & $3870. we are expected buying on sudden dips up to our support level with stop loss below $3860 and target up to $4000 – $4035 & $4060.