Jai Siya Ram

Here are the full details of the recent announcement that India & Mauritius will settle trade in their local currencies (INR & MUR) — what it means, what’s going on, and what the implications are.

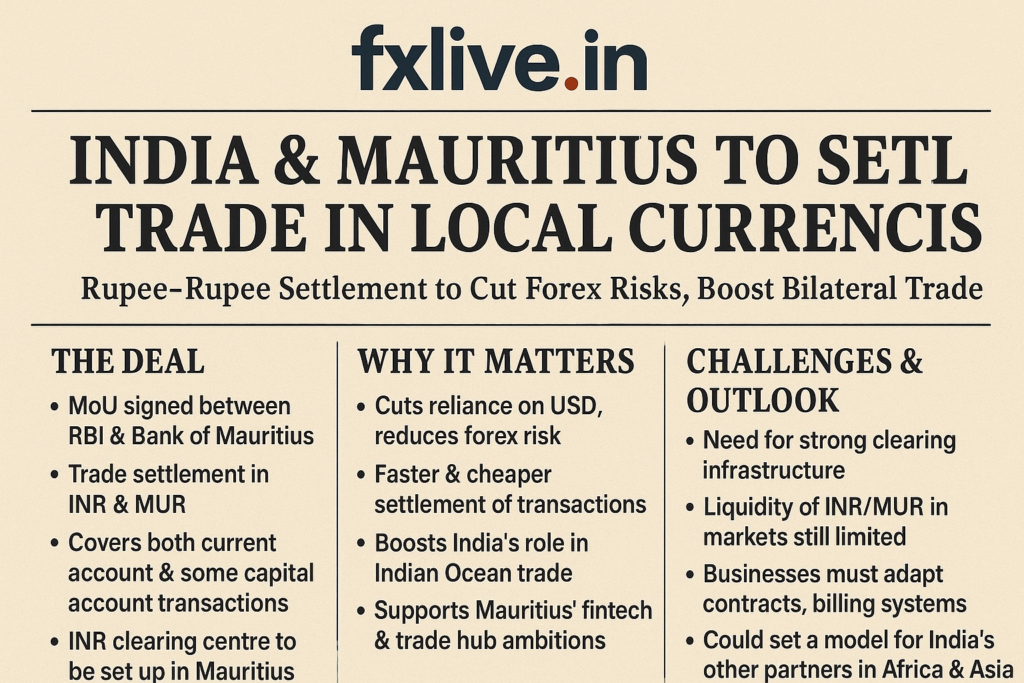

What Has Been Announced

- During Prime Minister Narendra Modi’s state visit to Mauritius (March 11-12, 2025), India and Mauritius agreed to start trading in their local currencies: the Indian Rupee (INR) and the Mauritian Rupee (MUR).

- The move was part of a larger framework of strengthening bilateral ties: under the India-Mauritius Joint Vision for an Enhanced Strategic Partnership.

- Both countries also plan to convene the High Power Joint Trade Committee under the CECPA (Comprehensive Economic Cooperation and Partnership Agreement) to further deepen trade cooperation.

Mechanisms & Preparatory Steps

- Earlier, the Reserve Bank of India (RBI) and the Bank of Mauritius (BOM) signed a Memorandum of Understanding (MoU) to establish a framework that allows and encourages the use of INR and MUR in cross-border trade transactions.

- The MoU covers both current account transactions and “permissible capital account transactions” agreed upon by both nations. This means not only simple imports/exports but also certain cross-border capital transfers, investments, etc.

- Part of the agreement includes setting up an INR Clearing Centre in Mauritius and potentially including INR as a settlement currency in Mauritius’ Automated Clearing and Settlement System. That would allow Mauritian banks and importers/exporters to hold accounts in INR with easier settlement.

Why It’s Significant

- Reduced Dependency on Foreign Exchange Risk

Using INR & MUR directly means fewer dependency on the US Dollar or other major currencies for bilateral trade. This reduces exposure to forex fluctuations, exchange rate risk, and foreign currency transaction costs. - Cost & Settlement Efficiency

Transactions in local currencies typically settle faster, with lower fees and fewer intermediaries. It can reduce banking charges tied to foreign exchange, and simplify invoicing. - Strengthening Financial Integration

The INR-MUR settlement framework can deepen financial ties, encouraging Mauritius as a hub for INR transactions (e.g. clearing, settlement) for the region. It could also foster more trade. - Strategic & Bilateral Relations Boost

The move is a gesture of trust. Since Mauritius has historic, cultural, and economic ties with India, this strengthens India’s influence in the Indian Ocean region and in Africa more broadly (given Mauritius’ linkages).

Challenges & What’s Left Unclear

- Implementation Details: While the MoU is signed, how quickly trade (exports/imports) will fully shift to local currency settlements, and in which sectors, is not yet clearly defined.

- Exchange Infrastructure: Clearing centres, agreements with commercial banks, currency liquidity (having enough INR in Mauritius and MUR in India), foreign exchanges between banks need to be set up properly.

- Capital Account Transactions Limitations: Not all types of capital transactions are permitted, so investment flows, repatriation of profits, etc., may still face restrictions or need special permission.

- Foreign Exchange Risk Still Present: Even when transacting locally, fluctuations in each country’s currency vs others (including USD) matter. Also, importers may still need foreign currency if input materials are priced internationally.

- Awareness & Adoption: Businesses need to adapt contracts, accounting, legal frameworks to bill and pay in local currencies. There might be market hesitation initially.

What It Means in Broader Context

- This is part of a larger global trend where nations (especially in Asia, Africa) are exploring local currency trade and settlement systems to reduce dependency on strong foreign currencies.

- For India, it aligns with foreign policy goals of de-risking, improving regional economic influence, and boosting financial diplomacy.

- For Mauritius, it can help reduce transaction costs, strengthen its currency’s acceptability, and also make trade with India more streamlined.

- It may set an example for other similar bilateral arrangements, especially where trade volumes are substantial, and there is mutual benefit in reducing FX costs.