Jai Siya Ram

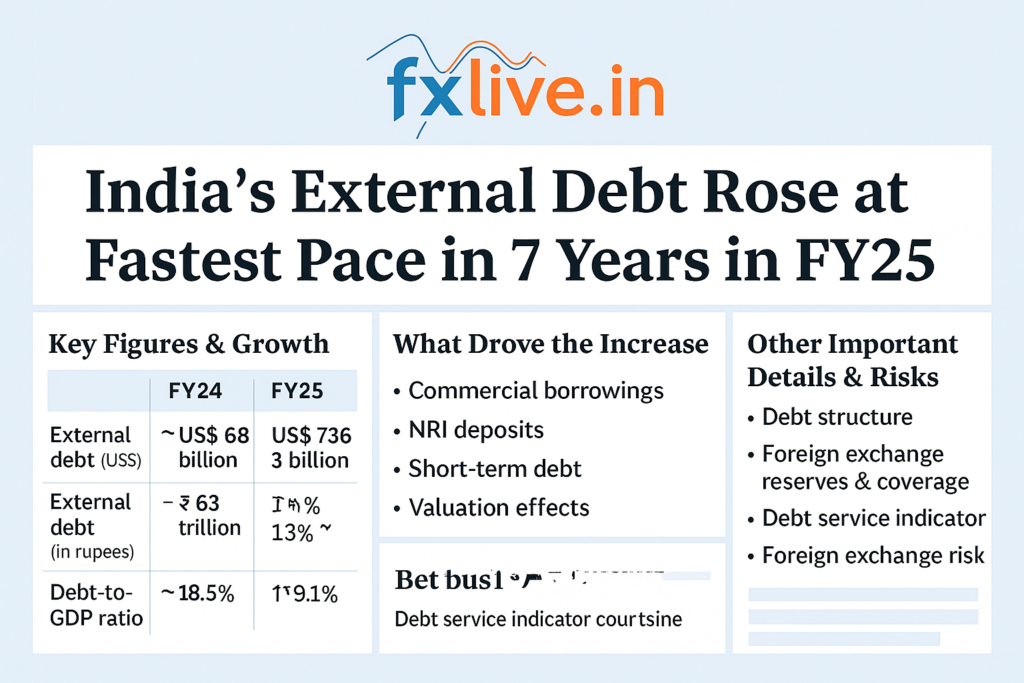

What Drove the Increase

The rise wasn’t uniform; certain segments were especially responsible:

- Commercial Borrowings: This was the biggest contributor. About US$41.2 billion of the increase came from commercial borrowings.

- NRI Deposits: These deposits rose significantly, adding several billions to the external debt.

- Short-term debt: Increased in absolute size though its share of total external debt fell slightly.

- Valuation Effects: Because the US dollar strengthened vs. the rupee (and other currencies), India’s external debt got a boost of ~US$ 5.3 billion just from currency/valuation changes. Without this, the growth would have been a bit higher in actual borrowing terms.

Other Important Details & Risks

- Debt Structure:

Most debt remains long-term. The short-term debt by “original maturity” is about 18.3% of total external debt.

Also, the “residual maturity” short-term obligations (i.e., debts maturing in the next 12 months, whether originally short or long) have increased. - Foreign Exchange Reserves & Coverage:

India’s forex reserves are large enough that they cover a large portion of the external debt. The reserve assets rose sharply in Q4 FY25.

The coverage of external debt by forex reserves stood around 90.8% at the end of March 2025. - Debt Service Indicator:

The debt service ratio (interest + principal repayments / receipts) fell slightly to ~ 6.6% in FY25 from ~ 6.7% in FY24. - FX Risk: Over half the external debt is USD-denominated etc., so any weakening of rupee can increase cost of servicing. Also, valuation effects can add volatility.

- Economic Growth Context: Nominal GDP growth was lower than external debt growth in rupee terms, which contributes to rising debt/GDP ratio.

✅ Overall Assessment

- The debt levels remain manageable, given strong forex reserves and a structure tilted toward long-term obligations.

- But there is heightened external vulnerability from rising commercial borrowing & short-term maturities, especially in a world of global interest rate volatility and potential currency swings.

- Keeping a close eye on capital inflows (FDI / ECB approvals etc.) and preserving reserve strength will be important in the coming year.