Jai Siya Ram

What’s Going On

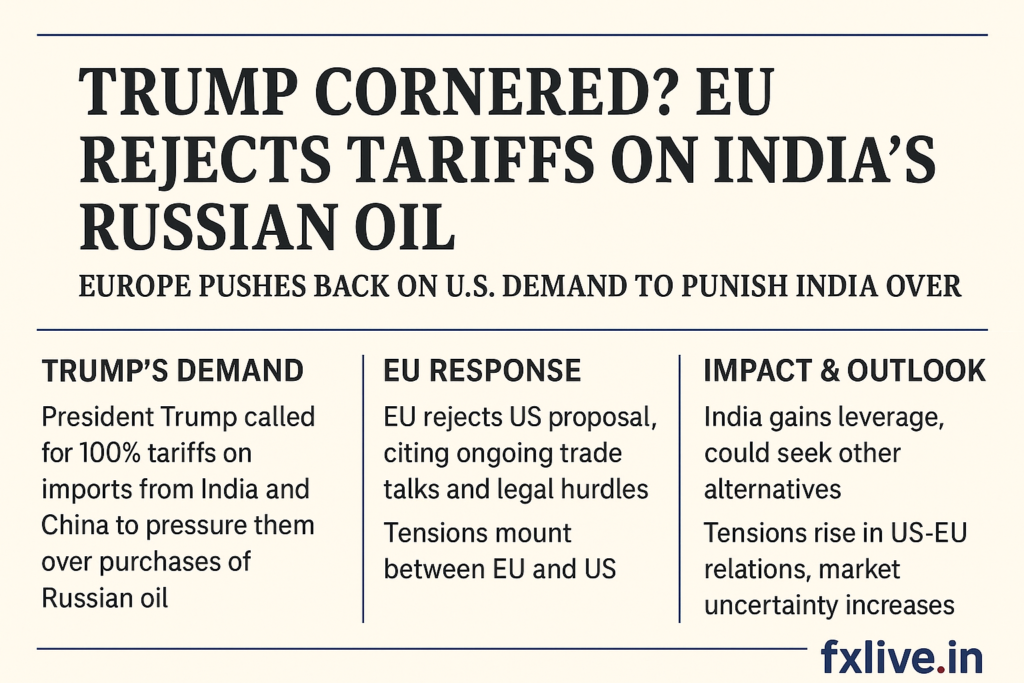

- Trump’s Proposal

U.S. President Donald Trump has urged the European Union (EU) to impose tariffs of up to 100% on imports from India and China. The rationale given is to punish them for continuing to import Russian oil, which Trump argues helps finance Russia’s war in Ukraine. - EU’s Response

The EU has rejected or is very unlikely to go along with Trump’s call for such extreme tariffs. Officials inside the EU have said:- There has been no formal discussion about imposing 100% tariffs on India or China.

- Tariffs, especially high ones, require strong legal justification, investigations, and risk wide economic fallout.

- The EU is in ongoing trade negotiations with India (Free Trade Agreement talks), which it would be reluctant to jeopardize.

- Background: Why India, China & Russian Oil

- India and China are among the largest importers of Russian crude oil, especially since oil from Russia has often been available at a discount.

- After Russia’s invasion of Ukraine, many Western countries (including EU members) put in place sanctions and price caps aimed at limiting how much revenue Russia could get from oil, while still allowing some trade under conditions.

- The U.S. has already imposed tariffs on Indian goods (50%) for Indian imports to the U.S., in response to India’s oil trade with Russia

- Why the EU Rejected the Tariff Demand

- Legal & Procedural Hurdles: The EU treats tariffs differently than sanctions. For broad tariffs to be introduced, there typically needs to be a legal basis—proof that the imports are harmful, that there’s a fair process, etc. High tariffs (like 100%) risk violating WTO rules or provoking trade disputes.

- Trade Diplomacy & FTAs: India is in trade talks with the EU. Imposing broad punitive tariffs now could sabotage those negotiations. Officials reportedly see India as a strategic trade partner, not just a country to pressure via punitive trade measures.

- Economic Risk for Europe: European countries depend on trade with India and China for many goods. Tariffs on such a scale would raise costs, disrupt supply chains, and could lead to retaliation.

- Alternative Measures Preferred: Instead of blanket tariffs, the EU appears to prefer more targeted sanctions—on specific companies or banks underwriting the trade, or refining entities, rather than sweeping tariffs on all goods.

Effects & Implications

- For India

- Relief in terms of trade relations with Europe. India’s exporters (especially in sectors like textiles, pharmaceuticals, engineering goods) may have avoided large-scale disruptions.

- Boost in market sentiment. Stock markets responded positively to the EU’s rejection of the proposal.

- For U.S.-EU Relations

- Some friction: EU rejecting Trump’s proposal shows a divergence in approach between Washington and Brussels on how to pressure Russia, especially via trade tools vs. sanctions.

- It suggests the EU isn’t willing to just follow U.S. policy when it clashes with its trade interests or legal standards.

- For Global Sanctions Regime

- Possible weakening of unified pressure if major powers disagree. The U.S. pushing for hard measures like 100% tariffs, while EU resists, could lead to inconsistent enforcement or loopholes.

- Could push India & China closer to non-Western trade partners or enhance trade among non-aligned nations, especially if Western pressure increases but without coordination.

- For the U.S. Policy Approach

- Trump’s approach of using tariffs as leverage is aggressive, but such demands may be less effective if allies don’t follow.

- Politically risky: Using trade and economic coercion in international policy sometimes backfires or causes pushback from both domestic and foreign stakeholders.

What to Watch Going Forward

- How the Free Trade Agreement talks between India and the EU proceed. Completion of the FTA (if by year-end) may hinge in part on these tensions.

- Whether the U.S. escalates further (e.g. imposing more tariffs, pulling more trade bells & whistles) or tries different pressure methods (sanctions, financial tools).

- How India responds — diplomatically, economically, maybe even by diversifying its trade partners further.

- Potential retaliation from India or China, or shifting alliances (e.g. trade blocs outside of U.S./EU influence).